Tax hiatus or deficit problem?

15 Aug 2009 - Bruno Prior

It is becoming popular amongst Keynesians (and perhaps some monetarists too) to suggest that Western governments do not have a deficit problem, they just have a hiatus in their tax receipts. Government's job, therefore, is to help the economy get back to a healthy state as quickly as possible (through deficit spending, low interest rates and quantitative easing), at which point tax revenues will be restored, the deficit will be eliminated, and normal service will resume.

Ummm... No. Here's a statistic that shocked me:

In real terms, the projected US deficit this year is more than the combined US deficits for the three years from 1943 to 1945.

This is from White House figures (see Table 1.3 of the Historical Tables of the Office of Management and Budget). Converted to year 2000 dollars, the projected deficit in 2009 is $1,440.1 billion ($1,841.2 billion in current dollars), and the deficits in 1943, 1944 and 1945 were $486.2, $448.2 and $456.8 billion respectively (in 2000 dollars). These were the previous highest deficits run until this year, with somewhat more justification.

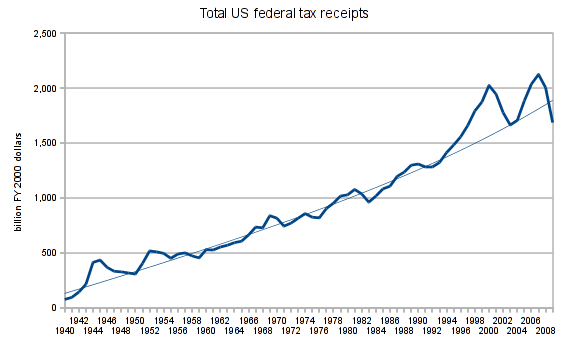

This deficit isn't principally due to a collapse of tax receipts below the norm. In real terms, the total projected tax receipts in 2009 are higher than the total receipts in 2003 and 1997. In between, we have had two huge bubbles (in fact we were already well into the first bubble by 1997).

Depending whether you think we returned to trend in 2003-4 or remained above it (we could get a better fit with the period from 1940-1995 on the assumption that it remained above), the projected downturn has overshot the trend by somewhere between a few billion dollars and a couple of hundred billion dollars. That leaves $1.25 to $1.4 trillion in 2000 dollars ($1.5 to 1.8 trillion in current dollars) of deficit unaccounted for by tax revenue that might reasonably be anticipated, in the absence of another bubble even bigger than the preceding two.

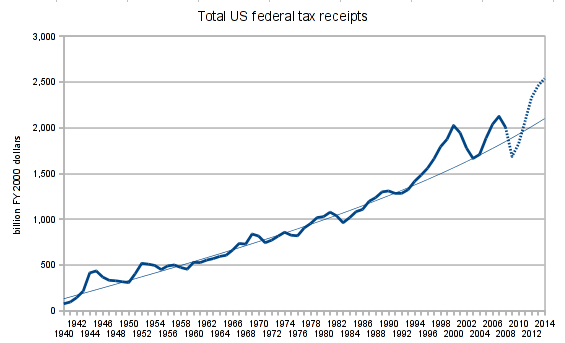

That doesn't stop the Obama government from projecting exactly that, however. Here is how the above graph looks if we add in their projections for tax revenue to 2014:

By 2011, they project that tax receipts will have returned to a level where they exceed the 2000 peak during the first bubble, and are only a little short of the 2007 peak in the second bubble. The following year (2012), they plan to excede the 2007 tax peak by almost 10%, and by nearly 20% by 2014. And even then, spending will be so much higher than these new peaks that they will still be running deficits of nearly $400 billion, and the deficit will be going back up again. They project the average spending in the period 2009-2014 to be 27% higher than it was at the tax-revenue peak in 2007, at which time they were already running a deficit of $133 billion.

All of this is in real terms, in 2000 dollars. The figures in current money will be significantly higher.

There is only one way to try to achieve this, and that is to blow the biggest bubble in history - a bubble to make the roaring twenties or the recent lunacy look sane. Failure and disaster are inevitable. The only question is when. Will markets buy this fantasy for a while (i.e. continue to buy Treasuries and/or hold off dumping the dollar) or will they return to sanity soon and prevent the US government from running up a bill it can't afford to pay back?

Note that this is not to say that other countries are much better, their projections more realistic, or their market bubbles more rational. This is the most egregious example of a more widespread delusion. All governments' stimulus plans and projected budgets are unrealistic. They will have to be curtailed, and hence will fail to deliver the economic recovery that markets are currently pricing in (but which they wouldn't have delivered even if they could somehow have been funded). It's not about flight from one currency to another, but flight from all fiat currencies.

There will be no alternative to major real cuts to government budgets, services and welfare provision, at the same time as unemployment is soaring from a reduction in public-sector employees to match the earlier reduction in private-sector employees. A shrunken economy will face a higher tax burden (proportionately) because of the imbalance between private-sector earnings and public-sector costs, despite reduced numbers of public-sector employees. The weight of taxation will inhibit economic recovery.

Our troubles have only just begun.

POSTSCRIPT:

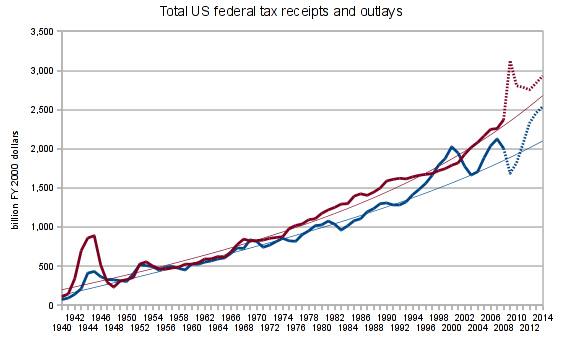

I was remiss in providing graphical representations only of the trajectory of tax receipts and not also of federal outlays to give a visual indication of the (budgetary and reality) gap. So here it is:

Clearly, the trajectories set by the historical trend over the past 35 years are unsustainable. And yet the projections of the Obama administration are massively more optimistic than those unsustainable trends. They are so fantastic that they make the Lord of the Rings look like cinema verite. What people need to ask themselves is what happens when governments fail to deliver on their fantastic projections?